2016-04-07

Identity documents from the Panama Papers. Clockwise from top left: Patrick Henri Devillers, Jia Liqing, Hu Dehua, Deng Jiagui and Li Xiaolin.

ICIJ

As more details emerge from the Panama Papers, Chinese censors are fighting to ensure the top-down deletion of information that details how Chinese high-ranking political and financial elites managed and hid their wealth offshore.

“All websites: Please self-inspect and delete all content related to the Panama Papers leak, including news reporting, microblogs, WeChat, forums, community pages, bulletin boards, cloud storage, comments and other interactive media,” an April 4 national-level directive from propaganda officials said.

“Delete mobile content at the same time,” said the order, which was translated and posted online by the China Digital Times (CDT) website.

The massive leak of 11.5 million files from Panama law firm Mossack Fonseca has revealed details of the operations and ultimate, hidden ownership of a slew of offshore shell companies, including those owned by family members of top Chinese leaders and Chinese celebrities.

“Offshore companies incorporated in offices in China and Hong Kong account for 29 percent of Mossack Fonseca’s active companies worldwide,” a global investigation by the International Consortium of Investigative Journalists (ICIJ), the German newspaper Süddeutsche Zeitung and more than 100 other news organizations, reported.

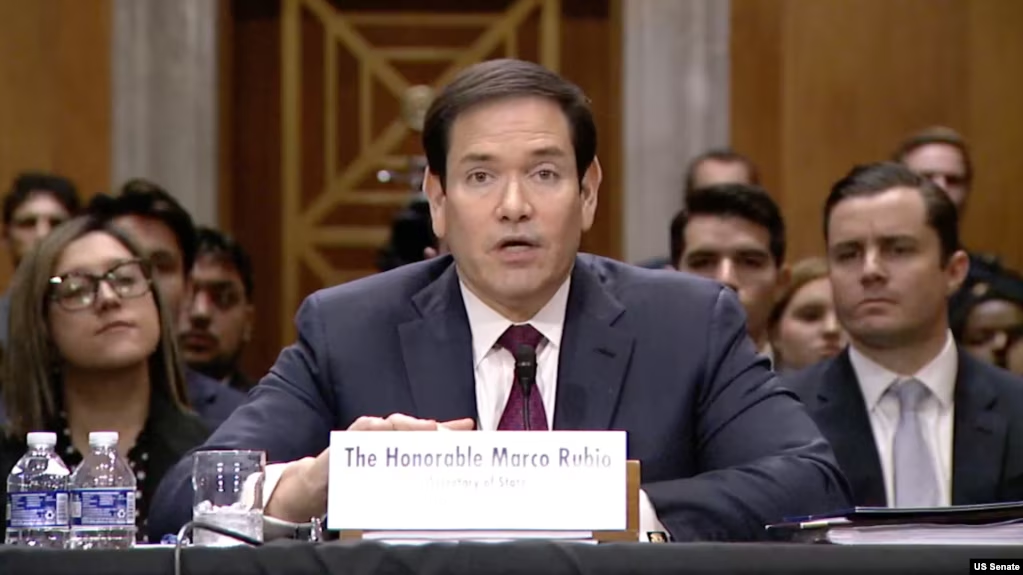

Included in its report was the brother-in-law of Chinese President Xi Jinping, Deng Jiagui, and the daughter of late former premier Li Peng, Li Xiaolin, both of whom were named in leaked documents as the beneficiaries of companies incorporated in the British Virgin Islands.

Repeated calls to one of the companies owned by Deng rang unanswered during office hours on Thursday.

Mao Zedong’s grandson

Now, reports have emerged that relatives of five other high-ranking Chinese leaders including revolutionary icon Mao Zedong also appear in Mossack Fonseca’s records.

Mao’s grandson by marriage Chen Dongsheng set up British Virgin Islands-based Keen Best International in 2011, while Hu Dehua, son of late ousted premier Hu Yaobang, is the ultimate beneficiary o Fortalent International Holdings, that was also incorporates in the BVI.

According to the ICIJ website: “Hu Dehua registered the company using his home address — the traditional courtyard home where his father lived while party chief.”

More current Chinese political figures also make an appearance in the documents.

Politburo standing committee member Zhang Gaoli’s son-in-law Lee Shing Put is named as a shareholder of three BVI companies: Zennon Capital Management, Sino Reliance Networks Corporation and Glory Top Investments.

Jia Liqing, daughter-in-law of fellow Politburo member Liu Yunshan is director of BVI-incorporated Ultra Time Investments Ltd., while Zeng Qinghuai, brother of former vice president Zeng Qinghong, directs the offshore China Cultural Exchange Association, now registered in Samoa.

Repeated calls to the propaganda ministry’s listed number in Beijing resulted in a “no such number” message.

According to the anti-censorship website GreatFire.org, the ICIJ’s website has been blocked in China since Monday, but was only 80 percent blocked on Thursday.

A matter of time

A journalist who gave only his surname Huang said Internet censorship wouldn’t be able to prevent the news of the Chinese names revealed in the Panama Papers forever.

“Now that it’s all over the media, it’s just a matter of time before it will find its way into the country,” Huang said. “Even the Chinese government won’t be able to keep it out.”

He said the Panama Papers are likely already creating political shock waves among the ruling Chinese Communist Party’s members, where there has been mounting resistance to a nationwide anti-corruption campaign launched by President Xi Jinping in 2012.

“As for how they deal with those whose information has been leaked in these files, that will all probably be negotiated as part of a political power struggle,” Huang said.

He said Xi is likely to try to use the information in the documents to pursue more high-ranking officials on corruption charges.

“But I don’t think they will take action against all of them, because there are far too many people involved,” he said.

Mossack Fonseca’s customers from China aren’t just related to its political elite, but include celebrities like Jackie Chan and wealthy businesspeople like mall magnate Shen Guojun, both of whom are listed as shareholders in a BVI-based company called Dragon Stream.

Parking the cash

It has long been suspected that much of China’s offshore wealth also boomerangs back into China, sometimes via Hong Kong.

In the case of soft drinks heiress Kelly Zong, the purpose of her Purple Mystery Investments company was listed as “investment in China.”

A Chinese academic source who asked to remain anonymous said many of Zong’s peers are following suit.

“A lot of them have business operations inside China,” he said. “The money comes back into the country as investments by overseas companies.”

He added that the leaks suggest China’s richest people are finding it harder to park their money where it won’t be found.

“It’s a bit risky for them just to stick the money in banks in the United States or Switzerland, so they have to find somewhere a bit more exotic to put it, via shell companies,” the source said.

He said they are also likely to close ranks in the face of the scandal.

“They are very used to covering these things up, and Chinese people have short memories,” he said. “In a while, it’ll be as if nothing ever happened.”