Last Updated: February 17, 2017 9:18 AM

BEIJING — The mystery surrounding a politically-connected Chinese billionaire’s sudden removal from a hotel in Hong Kong — and China’s silence about the case — is perpetuating a state of fear among investors and businesses, analysts say.

It is still very difficult to say with any certainty why Xiao Jianhua was suddenly seized from the Four Seasons Hotel late last month and taken to China. But his case highlights both the necessity of having political connections when doing business in China and the risks that go hand in hand with such ties.

Political ties

Xiao is the head of a holding company called Tomorrow Group, which has stakes in real estate, insurance, coal and cement firms. His rise to a position of influence began early on when he was admitted to China’s prestigious Peking University in the late 1980’s. During China’s pro-democracy demonstrations in 1989, he was loyal to the party where he served as head of an official student organization.

After his graduation, Xiao gradually rose to prominence and in more recent years has served as a banker for China’s politically connected and wealthy families. In 2014, Xiao told The New York Times that he helped the family of Chinese President Xi Jinping dispose of their assets.

Xiao’s company, however, in that same year denied that political connections were the key to his company’s success, instead arguing that they merely followed Warren Buffett’s value-investing strategy. That statement was made in a rebuttal to The New York Times story on the billionaire.

A statement of Chinese billionaire Xiao Jianhua is printed on the front page of local newspaper Ming Pao in Hong Kong, China February 1, 2017.

Crucial time

His rendition from Hong Kong, as some reports have described, comes at a crucial time. His disappearance occurred just months ahead of a once in five-year power reshuffle in China that is seen as crucial for President Xi to solidify his power. Because of that, some have seen his removal from Hong Kong as a political move.

“He’s a rich guy, he stays in Hong Kong. He’s very well-connected, very mysterious and people always want to understand him more because they know he is well connected with Chinese government officials,” said one venture capitalist who did not want to be identified because of the sensitive nature of this story.

The source added that while many things are unclear, it is clear the move was politically motivated.

In China, “money and politics are always linked with each other. They interfere and influence each other,” the source said.

Chinese authorities have yet to clearly state where Xiao is or why he was scurried away from his de facto headquarters in Hong Kong (his company is based in Beijing), and that is feeding speculation about his disappearance.

Some have said he was previously free to speak with family and friends and was in Beijing, but in recent days, even that connection has been cut off. Earlier this week, The New York Times reported that members of his company have been barred from leaving the country.

Given the upcoming Communist Party power reshuffle, some have speculated that factions opposing President Xi were behind the move, while others suggest Xi himself stepped in to minimize any possible damage.

But, without any official comment on the matter, it has been difficult to draw any clear conclusions.

“No matter which [political] faction is trying to use him to weaken the other rival faction, there will be a slew of many others who will be involved or implicated. His arrest won’t be the end of the story,” says one political scientist based in Hong Kong. “The more people involved, the more developments and possibilities there will be.”

Environmental risks

Xiao is not alone, nor are his circumstances entirely new. Unlike most, however, he has amassed a large amount of wealth. According to the Hunrun Report, which tracks the wealth of Chinese billionaires, Xiao has an estimated worth of about $6 billion.

Economists note it is difficult for businessmen operating in China to expect to make profits without maintaining close connections with politicians. And with political situations always changing, those businessmen are always at risk.

“No matter which side you bet on, you will be put in an awkward position when the table is turned among different [political] forces,” one Chinese economist tells VOA. “That means your business may be affected by the role you play.”

One country, two systems?

In Hong Kong, Xiao’s disappearance has created a climate of fear, and some are already reportedly looking to move their assets elsewhere. One big question for many is why Xiao decided to remain in Hong Kong instead of moving elsewhere given the increasingly tight political environment in China under Xi Jinping.

Hong Kong, a special administrative region, was long seen as a safe haven from China. After its return to China from Britain in 1997, the port city was guaranteed basic rights that are not commonplace on the mainland in a formula called “one country, two systems.” But, over the past few years, concerns that those rights are beginning to erode have blossomed.

Just last year, five men linked to a Hong Kong book publisher that focused on gossip about China’s leaders were abducted; three of them in China, but two others were taken against their will to the mainland. One of the abducted booksellers was seized in Thailand and another in Hong Kong.

Without any clarity about the incident, even those who may think it is a positive move will begin to raise questions about the rule of law in China, how the Chinese government treats dissidents and even the “one country, two systems” model.

“As long as there is no solid evidence available to clear up any doubts (about the case), the incident’s spillover effect will only get worse and exaggerated since many tend to let their imagination run wild,” one analyst in Hong Kong said.

Get physical

What is clear, the venture capitalist told VOA, is that Xiao’s disappearance is likely to further fuel an ongoing exodus of capital from the county.

“I think it is going to trigger some global asset allocation,” the venture capitalist said. “More money will be going toward these globally well regulated, liquid and transparent places.”

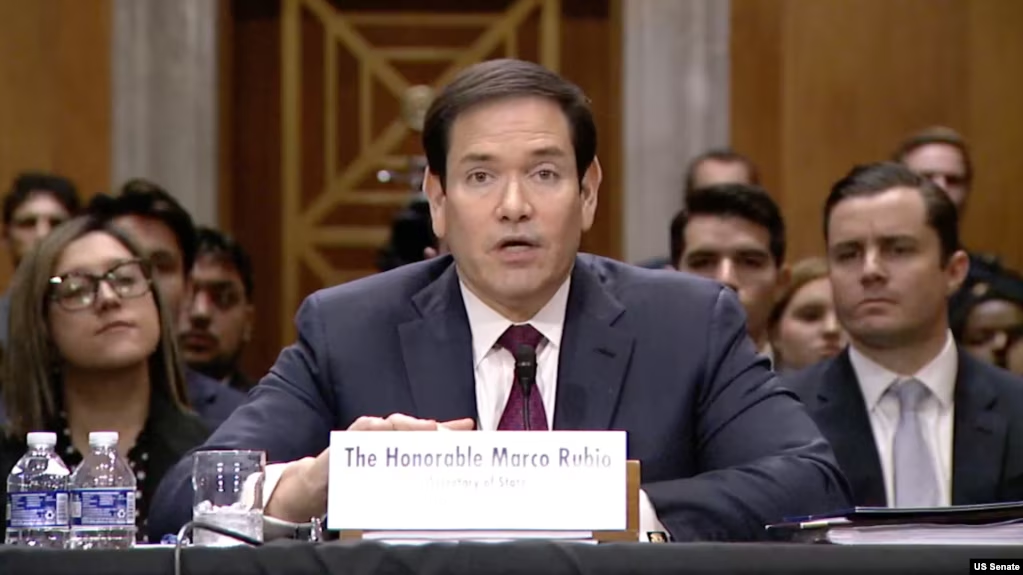

Over the past few years, China has seen a dramatic rise in capital outflows. The venture capitalist said that despite the rhetoric about U.S. President Donald Trump, there are likely to be more investments in places such as the United States and Britain.

In the past, the rich may have viewed countries such as Switzerland or Luxembourg as safe places to park their money, but now increasingly they are seeing that it is better to invest in physical assets, be it infrastructure in Britain, companies in the United States or real estate in Australia.

“Xiao Jianhua case shows that even if you are sitting in a Four Seasons Hotel in Hong Kong, you are still not that safe,” the venture capitalist said.